DNO Sells Ekofisk PPF Stake to Orlen, Bolsters Cassio and Verdande Share

November 18, 2025

Norwegian oil and gas operator DNO has sold its 7.604% stake in the Ekofisk Previously Produced Fields (PPF) project on the Norwegian Continental Shelf to Orlen Upstream Norway, while acquiring new interests from Orlen as part of its ongoing North Sea portfolio adjustments.

The transaction involves the divestment of DNO’s share in Ekofisk PPF in licenses PL018B and PL018F, covering the redevelopment of shut-in fields expected to return to production in 2029.

In return, DNO has acquired a 20% interest in license PL1135, which contains the Cassio prospect, and a 0.8272% stake in the Verdande field.

“As we continue to high-grade our North Sea portfolio, our focus is on increasing near-term cash flow with less spend and more barrels more quickly.

“Ekofisk PPF covers redevelopment of older, shut-in fields with expected production start in 2029 and while the project fits other companies’ portfolios, we have chosen to deploy our share of the significant capital expenditure necessary in ways that play to our strengths, namely exploration and rapid-fire development of our existing discoveries,” said Bijan Mossavar-Rahmani, DNO Executive Chairman.

DNO will maintain its 7.604% interest in licence PL018, which includes the producing Ekofisk, Eldfisk and Embla fields, as well as its share in the Tor Unit.

The additional Verdande interest raises DNO’s position in the field unit, which comprises five licenses, to 14.8251%. Verdande, including 3.5% from the recently announced asset swap with Aker BP.

Located in the Norne area, Verdande is in advanced development and scheduled to start production later in 2025.

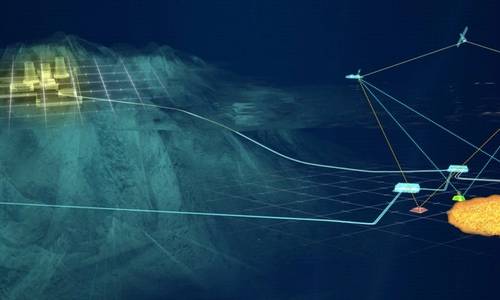

The Cassio prospect lies directly north of DNO-operated PL1086, which contains the Othello discovery. An exploration well on Cassio is planned for late 2026.

The all-cash transactions are conditional on customary government approvals.