From Regional Champion to Global Powerhouse: Inside ADES and Shelf Drilling Fleet Merger

by Sofia Forestieri

October 24, 2025

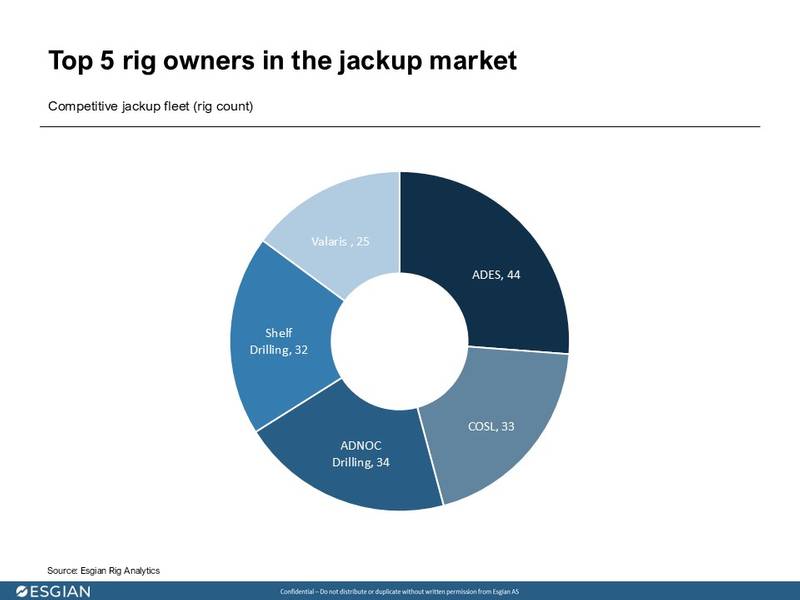

ADES is the largest jackup drilling contractor globally, with 44 rigs owned, and four under its management, and a fleet valued at $1.98 - $2.2 billion. Shelf Drilling, also among the TOP 5 jackup drilling contractors, has a modern 32-rig competitive fleet valued at $1.42 - $1.57 billion. Now, through a NOK 3.9 billion ($380 million) all-cash transaction, the two are forming a combined entity that not only redefines scale but marks a shift in global offshore drilling power.

The initial offer was of NOK 14 per share, but in September ADES increased the cash consideration offered to Shelf shareholders to NOK 18.50 per share. In a moment of market uncertainty, contract suspensions and cost discipline, this merger appears to carry a strategic premium. This offer likely exceeds near-term standalone valuation metrics but reflects a long-term vision: the creation of the largest jackup fleet globally by far, a major geographic expansion, a more diverse client portfolio (specially IOCs) and operational synergies.

© Esgian

© Esgian

The jackup drilling market has undergone significant transformation over the past decade, reshaped by downturns, bankruptcies, and bold mergers. In 2012, the leading contractors were Valaris (then Ensco), Shelf Drilling, Hercules Offshore, Rowan, and Noble. Through a wave of restructuring and consolidation, today’s dominant players are ADES, COSL, ADNOC Drilling, Shelf Drilling, and Valaris. While many past offshore drilling mergers were born out of financial restructuring or distress, ADES is paving a different way: leveraging capital strength and long-term vision to scale proactively, and strategically, on its own terms.

© Esgian

© Esgian

What Could be the Implications of the New Merger for the Market?

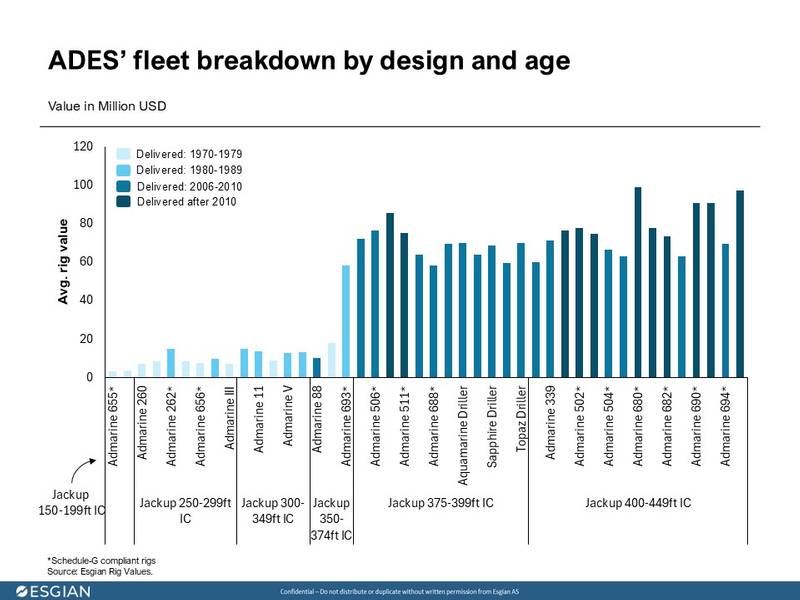

ADES’ fleet is diverse in terms of age and design. 36% percent of the rigs were built in the 1970s and 1980s, such as Admarine 656, Admarine III, and Admarine 657. Meanwhile, 23% are young, built after 2010, including Admarine 695, Admarine 680, and Admarine 510. Esgian values the ADES fleet at $1.98 - $2.2 billion, with older rigs valued between $2 and $5 million, and newer rigs valued between $91 and $105 million. It is worth noting that for Schedule-G compliant rigs outfitted to work for Saudi Aramco, Esgian has increased their average value by 5% compared to non-compliant rigs.

© Esgian

© Esgian

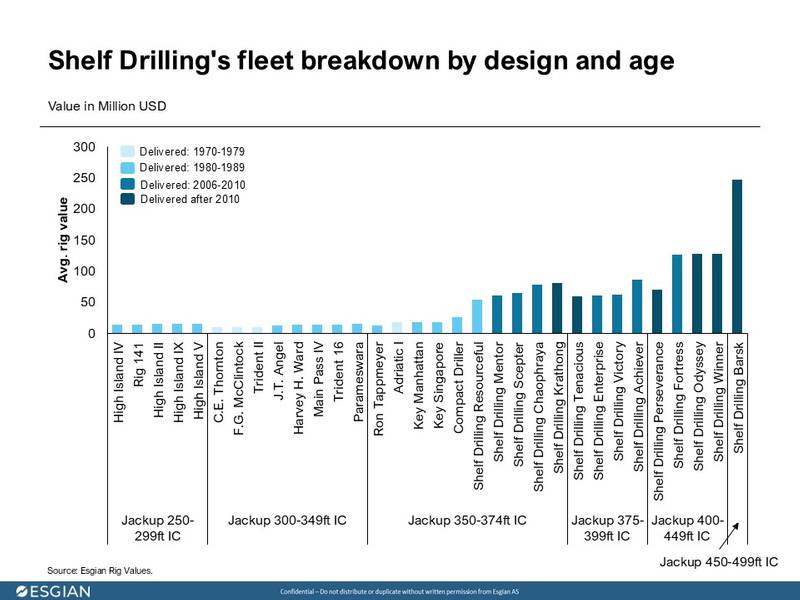

Shelf Drilling has undergone a significant transformation over the past decade, shifting from a fleet of aging standard/vintage1 jackups to a portfolio of premium2 and harsh-environment rigs. 45% of its fleet was built in the 1980s and 1990s, including rigs such as High Island II and High Island IV. The most modern jackups were delivered after 2007 and include Shelf Drilling Tenacious, Shelf Drilling Enterprise, as well as 492-ft Shelf Drilling Barsk.

This strategic shift has increased its fleet valuation to $1.42 - $1.57 billion, with older rigs valued at $7 to $11 million, newer rigs valued at $55 to $65 million, and the harsh-environment Shelf Drilling Barsk being the fleet’s highest valued jackup at $235 to $259 million.

© Esgian

© Esgian

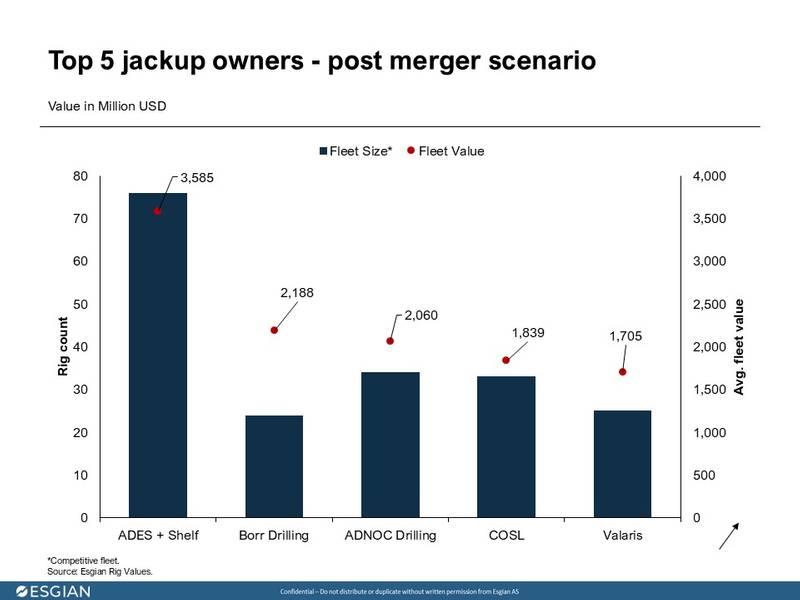

The new entity will have a combined competitive fleet of 76 jackups* (Trident XII is currently held for sale for non-drilling purposes and thus considered uncompetitive by Esgian). This will skyrocket its fleet valuation to $3.4 - $3.77 billion. The next largest player, ADNOC Drilling, holds a fleet worth $1.96 - $2.16 billion, 42% lower.

© Esgian

© Esgian

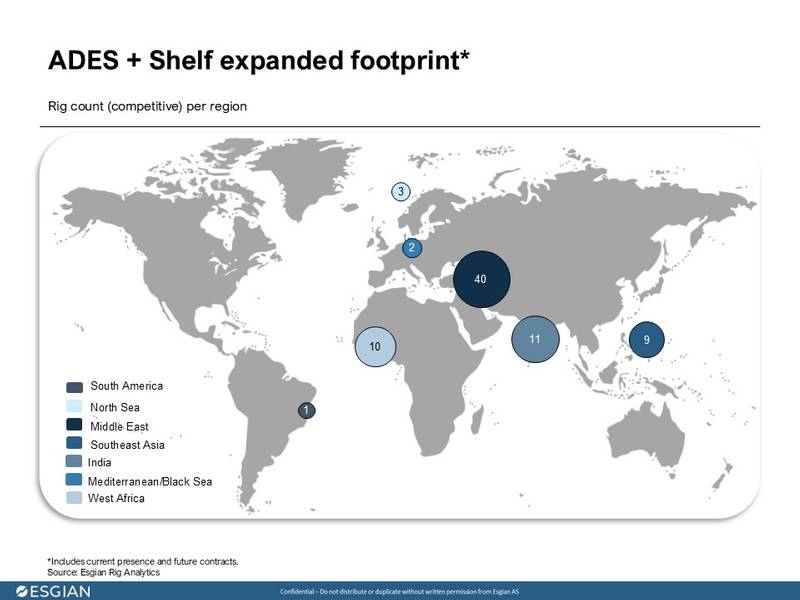

Shelf Drilling’s presence in Southeast Asia, India, and West Africa broadens ADES’s geographic reach beyond its core Middle Eastern markets. The combination enhances the group’s ability to serve clients across multiple regions, strengthens its position in the Middle East, and diversifies its customer base beyond Saudi Aramco.

ADES-Shelf Drilling Expanded Footprint Redrawing Competitive Map

As seen with the Noble-Diamond merger, consolidation often leads to divestment of older, less efficient rigs. Shelf Drilling has recently announced that it’s holding the Trident XII for sale for non-drilling purposes. Earlier this year, the contractor sold the Trident VIII for recycling to an undisclosed buyer, and the Main Pass I to Perenco for conversion.

Building on Shelf Drilling’s recent steps to streamline its fleet, Esgian has identified potential optimization opportunities the combined company may explore to improve efficiency and focus on higher-value assets. Likely candidates could be 1970s-built C.E. Thornton and F.G. McClintock, and Ron Tappmeyer.

In terms of market impact, this merger could create a power shift. With reduced competition, contractors may gain leverage in negotiating higher dayrates. Where ADES has aggressively grown through acquisition, Shelf has focused on modernization and diversification. Combined, they form a company with both cost discipline and strategic flexibility.

© Esgian

© Esgian

With this merger, ADES isn’t just consolidating rigs, it’s redrawing the competitive map. The combined entity becomes the clear leader in jackup drilling, not only in size and value, but also in geographic reach, fleet quality, and client diversity. It marks a turning point where Middle East capital, strategy, and energy ambition are no longer confined to local markets but are actively reshaping global offshore drilling dynamics.

Competitors will be watching closely. The new entity’s ability to offer competitive dayrates from a modern fleet, while leveraging scale and regional dominance, puts pressure on smaller players and reshapes the economics of shallow-water drilling. The industry may soon realize this was not just a smart deal, but as a turning point with lasting implications for fleet optimization, pricing power, and even future M&A activity across the sector.

*Esgian only considers competitive jackup offshore drilling rigs and owned assets by each contractor (excluding jackup barges and mobile offshore production units "MOPU").

1Standard - built 2008 and later, with design water depth of <350ft, non-harsh-environment.

2Premium jackups - built 2008 and later, with design water depth of >349ft, non-harsh-environment.

Explore the latest edition of Offshore Engineer Magazine which features the piece 'From Regional Champion to Global Powerhouse: Inside ADES and Shelf Drilling Fleet Merger' by Sofia Forestieri, Senior Analyst at Esgian, and many more provided by leading industry experts and journalists.