Inpex Moves to Accelerate Indonesia’s Abadi LNG Project

January 23, 2026

Japan's Inpex is working to advance the start of its Abadi project in Indonesia to meet the government's request to speed up and has seen strong interest from Western majors to buy liquefied natural gas, CEO Takayuki Ueda said.

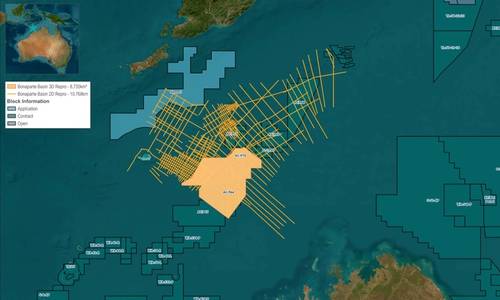

The long-delayed $20 billion project, which will produce up to 9.5 million metric tons of LNG a year, will be a major growth driver for Inpex, Japan's top oil and gas explorer. It aims to reach a final investment decision in 2027 for start-up in the early 2030s.

Jakarta has requested Inpex to accelerate the project to meet fast-rising local gas demand.

"We will make every effort to accelerate the project," Ueda told Reuters in an interview earlier this week, adding that the company is considering various design and contracting options despite challenges.

Strong Buying Interest

Asian importers and Western majors are keen to secure LNG produced in the region to meet rising power demand in 2030s, driven by data centre expansion, and for energy security due to heightened geopolitical risks, he added.

"We're still at the stage of non-binding expression of interest, but we're already seeing very strong interest from Asian countries and even supermajors," Ueda said.

Inpex, which owns a 65% stake in the project, began comprehensive front-end engineering design (FEED) in September, after starting initial work in April, but rising costs are a challenge, Ueda said.

The company is targeting an internal rate of return of about 15% and could negotiate with the Indonesian government for additional incentives such as tax support if the target is not met, he added.

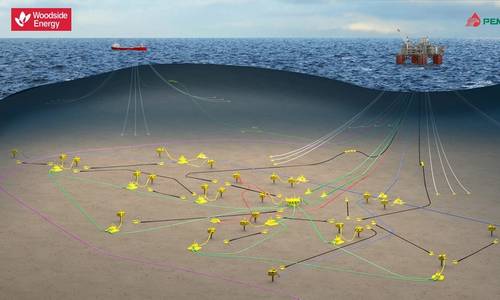

Ichthys

In Australia, Inpex is on the hunt for large gas resources to feed a third LNG train and to backfill existing capacity at its Ichthys project in Darwin, Ueda said.

"We aim to continue Ichthys production even after 2050, and are exploring various options," Ueda said.

"We have secured some assets such as the Cash Maple gas field near Ichthys and other discovered-but-undeveloped fields, but we are also in various discussions for larger gas sources," he said, adding there is interest in the onshore Beetaloo Basin in Australia's Northern Territory.

The company obtained a permit in 2015 to explore for shale gas in the Beetaloo.

"We are studying gas potential in the region," he said.

(Reuters - Reporting by Yuka Obayashi and Katya Golubkova in Tokyo, Additional reporting by Helen Clark in Perth; Editing by Florence Tan and Christian Schmollinger)