Navitas Eyes More North Falklands Exploration Acreage after Sea Lion FID

January 12, 2026

Navitas Petroleum has signed a non-binding agreement to farm into an offshore exploration license in the North Falklands Basin adjacent to its recently sanctioned Sea Lion oil development, as the operator advances plans to expand its footprint in the region.

Eco (Atlantic) Oil & Gas said Navitas has entered into a non-binding memorandum of agreement with JHI Associates for a farm-in to acquire a 65% working interest in the PL001 licence, where Eco holds a 6.6% interest through its stake in JHI.

PL001 lies next to the Sea Lion oil field, which reached final investment decision in December after approval from both Navitas and partner Rockhopper Exploration, and follows regulatory approval of the field development plan by the Falkland Islands Government.

The PL001 license covers about 1,126 square kilometers in around 500 meters of water depth and contains what JHI estimates as 3.1 billion barrels of oil across multiple prospects and leads, according to Eco (Atlantic) Oil & Gas.

The acreage includes Lower Cretaceous prospects analogous to Sea Lion, including Tyche, Dinlas, Rhea, Chatham and Selene.

PL001 is set to enter an optional 10-year third exploration phase from January 1, 2027. Among the license’s key prospects, Tyche and Dinlas are each considered potential recoverable targets of about 400 million barrels, with characteristics similar to Sea Lion.

“We are encouraged to see a further strengthening of our relationship with Navitas, this time through our holding in JHI. As part of our Strategic Partnership with Navitas, technical and commercial discussions in relation to our projects in both Guyana and South Africa are continuing and we look forward to keeping the market updated,” said Gil Holzman, president and chief executive of Eco Atlantic Oil & Gas.

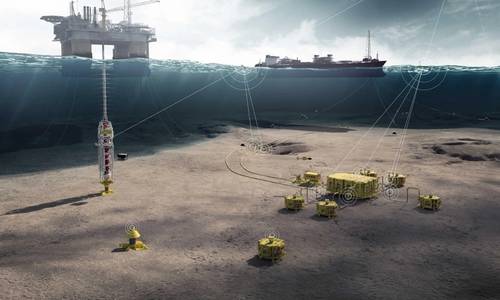

Sea Lion, operated by Navitas with a 65% working interest alongside Rockhopper’s 35%. An independent resource report by Netherland, Sewell & Associates in June 2025 estimated full-field 2C resources of 917 million barrels, including 321 million barrels net to Rockhopper, with 255 million barrels classified as development pending. NSAI assessed the NPV10 of Rockhopper’s 255 million barrels at $1.85 billion based on a $70 Brent oil price.

Phase 1 of Sea Lion is expected to target 170 million barrels with peak production of around 50,000 barrels per day and first oil planned for 2028. Phase 2 is expected to recover a further 149 million barrels.

Following the Sea Lion FID, Navitas has signed key commercial contracts including an FPSO charter, drilling rig agreements and SURF engineering, procurement and installation contracts.