North American Projects, Players and Deals Take LNG Market Spotlight

Marc Howson

November 6, 2025

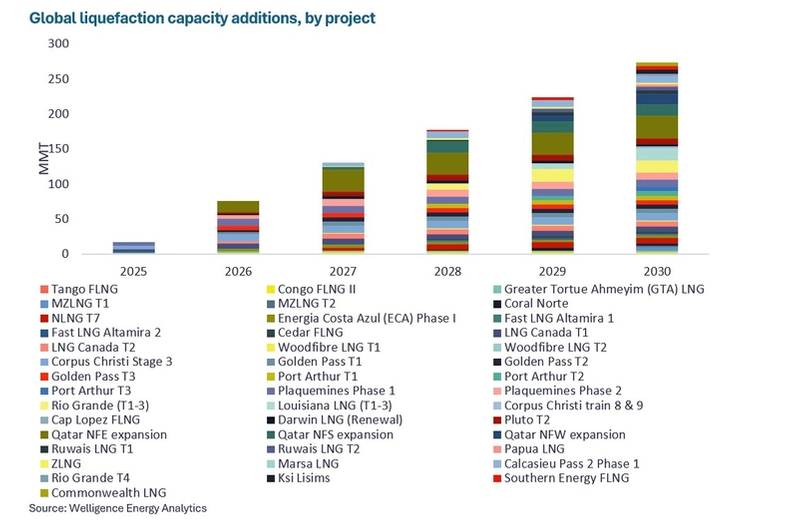

In 2025 to-date, five out of the six liquefaction projects reaching Final Investment Decisions (FID) globally, representing around 90% of liquefaction capacity, are located on the U.S. Gulf Coast. Despite an inflationary environment, geopolitical tailwinds combined with U.S. LNG’s flexibility and relative price competitiveness will accelerate further FIDs in the area over the next 12 months, including NextDecade’s Rio Grande LNG Train 5.

By 2030, the U.S. Gulf Coast will supply over 25% of global LNG production. Asian importers have concerns around high reliance on the area and are accelerating proposed projects elsewhere. Glenfarne Group is leading the proposed Alaska LNG project, from which CPC, PTT, and JERA have signed offtake agreements.

The 20 MMtpa-capacity development is targeted to reach FID in 2026 and benefits from low feed gas costs, much shorter shipping times to Asia, as well as plans to offer buyers a range of price indices. However, players are concerned about Alaska LNG’s cost competitiveness, given the necessary construction of its ~1,300 km gas pipeline.

© Welligence Energy Analytics

© Welligence Energy Analytics

Canadian LNG Re-Energized

Attention is also focused on western Canadian projects, following the government’s reinvigorated commitment to grow markets for the country’s vast gas resources. While the Shell-led LNG Canada project started up in mid-2025 and the Cedar LNG and Woodfibre LNG developments remain under construction, pre-FID opportunities are garnering most attention.

The Ksi Lisims LNG project is expected to reach FID in H1 2026, once it has contracted the majority of its output capacity. The development will harness two 6 MMtpa-capacity near-shore FLNG units, to be constructed over four years by Samsung, harnessing Black & Veatch liquefaction technology. While buyers’ uncertainties persist over the cost of the proposed Prince Rupert Gas Transmission pipeline to transport the feed gas across the Western Sedimentary Basin, LNG shipping costs into Asia could be approximately $1/MMbtu lower than from U.S. Gulf Coast projects. This month, Ksi Lisims LNG received its Environmental Assessment Certificate from the Government of British Columbia.

Furthermore, last month, the government created its Major Projects Office (MPO) to streamline approvals and help structure financing to accelerate critical Canadian projects. The 14 MMtpa-capacity LNG Canada expansion is expected to reach FID next year and is the first of five selected projects for MPO’s consideration.

Argentina LNG: Vast Opportunities but Hurdles Remain

The only non-U.S. Gulf LNG project to reach FID this year so far is Argentina’s 5.95 MMtpa-capacity Southern Energy FLNG. The development benefits from especially low capex, by harnessing feed gas from the world-class Vaca Muerta shale and chartering Golar LNG’s Hilli Episeyo and MK II FLNG vessels, which are both converted conventional LNG tankers, for 20 years.

Argentina LNG Phases 2 and 3, led by Shell and Eni respectively, are proposing another combined 22 MMtpa of liquefaction capacity, with each phase requiring two new-build FLNG units. Last month, YPF CEO Horacio Marín reaffirmed 2026 FID targets for the Shell and Eni phases and highlighted positive discussions, particularly with Asian LNG players, regarding farm-in partners and LNG off takers.

The FLNG component of Southern Energy LNG’s first phase was successfully admitted into Argentina’s RIGI incentive program, which provides it with legal stability, the ability to repatriate profits, dividends, and capital, and shields the project from new national, provincial, or municipal taxes. However, some players remain averse to making long-term investments in Argentine LNG projects, given the country’s traditional political volatility and following its short-lived Tango FLNG export experience during 2019-2020.

North America Leads LNG’s evolution

North American LNG production and FIDs will continue ramping up aggressively this decade, initially underpinned by the US Gulf Coast projects’ competitiveness and unique flexibilities. The developments will be further boosted by independent North American gas producers’ increasingly accelerating their international LNG volume and pricing exposures as well as the re-emergence of U.S.-focused banks in physical LNG.

About the author:

Marc Howson leads Welligence’s activities across Asia Pacific. He has over 20 years of global energy experience, encompassing roles in the UK, USA, Qatar and Singapore. Most recently, he was as a Director at S&P Global Platts, responsible for global LNG pricing, and GLX. After analyzing energy markets at Wood Mackenzie, Marc held senior roles in the LNG marketing teams of Qatargas and Gazprom Marketing & Trading.

© Welligence

© Welligence