Oil Companies Snap Up West African Blocks in Search for Next Big Thing

February 4, 2026

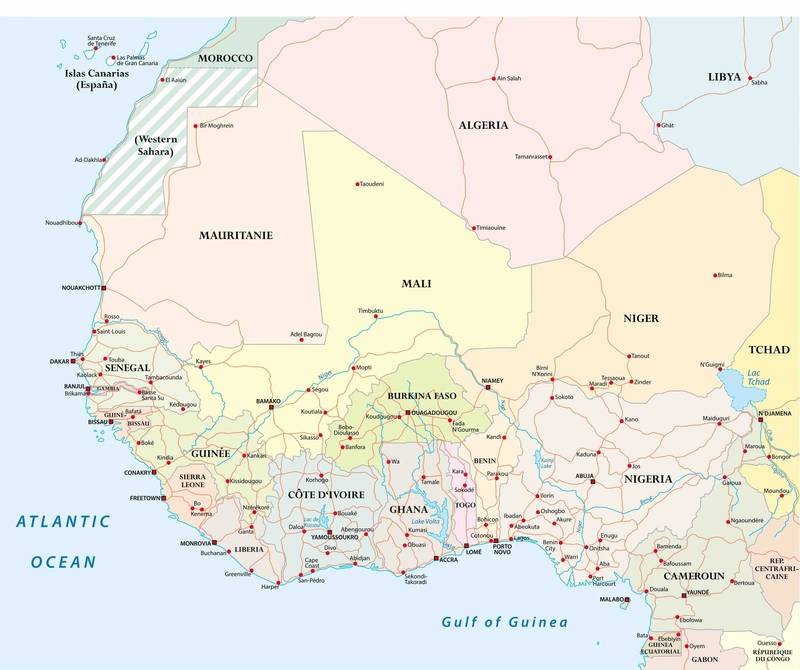

Chevron and TotalEnergies are among the oil majors snapping up offshore blocks in West and Southern Africa as compelling geology, regulatory reforms, and the need to restock spur a hunt for the next Brazil.

Companies are restocking their oil and gas assets given prospects for fossil fuel demand to stay higher for longer than predicted just a few years ago.

"The majors are clearly in something of an acreage reload and have been able to secure large acreage positions," said David Thomson, vice president of Sub-Saharan Upstream at Welligence energy analytics.

With growth in U.S. shale topping out, other regions are drawing fresh attention, including West and South Africa, with Shell, for example, returning to offshore Angola after a 20-year absence.

Of the oil and gas discovered since 2020, some 11%, or about 8.7 billion barrels of oil equivalent (boe), has been found along West Africa, most of it oil, said Justin Cochrane, African upstream regional research director for S&P Global Commodity Insights.

The region holds around 14% of the liquids discovered since then, or some 5.6 billion barrels, he added.

France's TotalEnergies has been the most active international player, last September finalising new production-sharing contracts in Nigeria, Congo Brazzaville and Liberia, according to Thomson at Welligence.

Angola, sub-Saharan Africa's second largest oil producer, introduced a presidential decree in late 2024 that included reforms and tax cuts aimed at making mature blocks more investible and spur exploration.

Angola about a year earlier also quit the OPEC group of oil-producing countries, freeing itself from output curbs.

"New exploration, such as in Angola, is important to sustaining production into the 2030s," Shell said last month as it announced a deal to buy stakes in two undeveloped offshore blocks.

Eni-BP joint venture Azule Energy has drilled Angola's first gas-specific exploration well and found potentially more than 1 trillion cubic feet of gas and up to 100 million barrels of condensate, it said.U.S. major Chevron entered the promising MSGBC (Mauritania, Senegal, Gambia, Bissau and Conakry) basin when it added two blocks off Guinea-Bissau in November.

"It just adds to a great suite of exploration blocks we have up and down the coast in West Africa, a super prolific area," Liz Schwarze, Chevron's vice president for exploration, told Reuters.

Peter Elliott of NVentures data analytics said the blocks might hold multi-billion barrels.

MAJOR DISCOVERIES

Similarities between the geology of Africa's underexplored west coast to huge productive basins on the other side of the Atlantic Ocean hold the promise of massive new discoveries, according to oil executives.

"Africa and South America are true Atlantic twins, bound by a shared geological history," said Gil Holzman, chief executive of Canada's Eco Atlantic Oil & Gas.

"Multiple major discoveries along the West African margin directly mirror successes in eastern South America, particularly offshore Brazil," he told Reuters.

Namibia has recorded the region's most discovered and recoverable resources at 6.2 billion boe, according to S&P Global Commodity Insights.

That's roughly five times the total for second-ranked Ivory Coast, and ahead of South Africa, Angola and Nigeria.

In its Orange Basin, one of the world's hottest exploration zones, joint venture Azule Energy, in partnership with operator Rhino Resources, last year made three offshore hydrocarbon discoveries as they compete with TotalEnergies in a race to first oil.

Privately held African explorer Rhino Resources plans to drill an appraisal well on a Namibian prospect this year and take a flow test on another as it looks to fast-track development.

Total is moving ahead with its Venus project in Namibia and has acquired a 40% stake in the Mopane mega discovery, estimated to hold at least 10 billion barrels.

Namibia has seen an above-average success rate of more than 70% in drilling campaigns, but complex geology and technical deep-water challenges persist.

Total, for example, has flagged a high gas-to-oil ratio at its Venus project.

Shell was also forced to take a $400 million writedown on an oil find off Namibia, but says it remains committed to further exploration.

Majors reserve life https://www.reuters.com/graphics/MAJORS-RESERVES/egpbbjmrlpq/chart.png

(Reuters)