Rystad Energy: No Surprises on Trump’s Day 1

January 22, 2025

Donald Trump’s first day as president saw him take action on the energy industry, but there were no surprises, says Rystad Energy’s Head of New Energies Research, Artem Abramov.

“In line with his election promises, Trump declared a national energy emergency and set out a general policy direction aimed at accelerating domestic oil and gas supply, immediately revoking former President Joe Biden’s pause on new LNG permitting.

“In terms of the impact on low-carbon energy sectors, our assessment of the pack of orders issued on Day One reveals no surprises.”

Rystad has identified four major immediate implications for renewable energy and cleantech sectors:

• Suspension of offshore wind permitting and Paris Agreement exit – in line with expectations but with potentially more significant international implications in his second term, as it could further strengthen support for anti-climate policies in Europe and other regions.

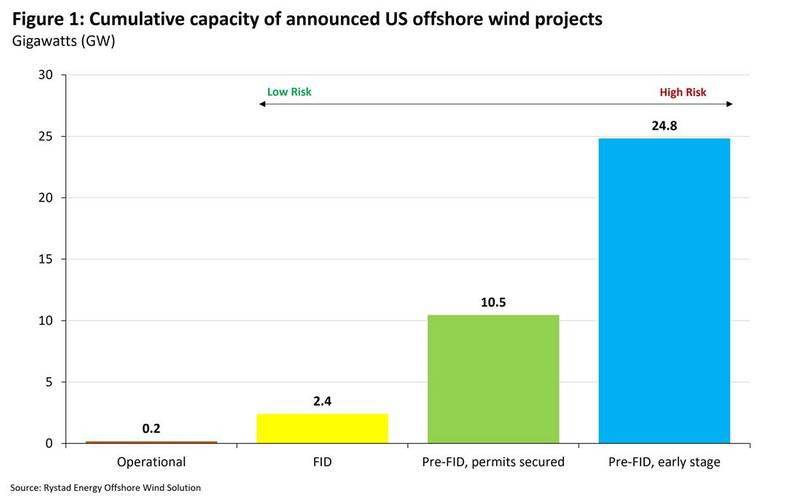

• Similarly, Trump issued immediate suspension of offshore wind energy permitting in line with his campaign promises. In essence, the chances of any new offshore wind developments in the US are zero for now. Moderate risk amid the unfavorable investment climate is present for 10.5GW of projects which secured necessary permits but have not reached investment decisions. The remaining 25GW of early-stage projects are unlikely to see any progress under the current administration.

• Moderately positive sentiment in the biofuels sector - Biofuels are explicitly mentioned in the list of domestic energy resources favored for accelerated permitting or development in Section 3 of the new administration’s ‘Unleashing American Energy’ order, together with oil, natural gas, coal, hydropower and critical minerals. In general, we believe that Trump will try to find a balance between support of the US farming and oil and gas industries, and significant disruption for US bioenergy in the next four or five years is unlikely. Uncertainty around the final rules for the clean fuel tax credits persists.

• Electric vehicles heavily targeted. The first day orders were heavy on the reversal of electric vehicle (EV) support programs.

“We do not think there are immediate implications for any other cleantech or renewable energy sectors from the first series of executive orders,” says Abramov. “US upstream low-carbon energy spending increased from $84 billion in 2021 to $131 billion in 2024. Our current estimate suggests spending further increased roughly 15% in 2025, to $151 billion per year.

“While growth in 2025 is largely inertial and set in stone, continuous low-carbon market expansion in the US from 2026 onwards depends on successful government support for Section 45 and 48 credits and US Department of Energy loan programs.”