Sea Lion Offshore Oil Project in Falkland Islands Targets FID in Mid-2025

March 24, 2025

A final investment decision (FID) for the Sea Lion development offshore the Falkland Islands could be reached in mid-2025, according to Rockhopper, which is partner in the project with the operator Navitas Petroleum.

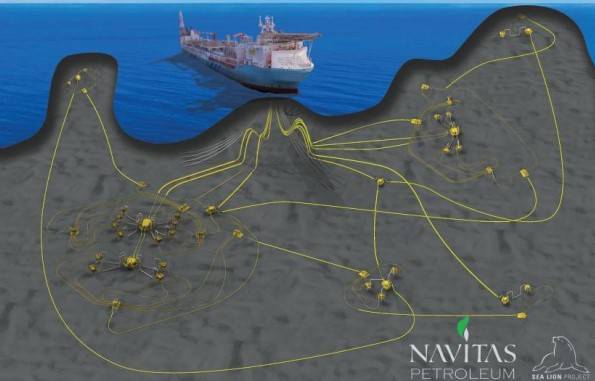

Navitas continues to estimate Capex to first oil on phase 1 of c$1.4 billion and in this regard has entered into a number of FEED agreements including an MoU for an FPSO which is currently operating in the North Sea, along with various agreements relating to the provision of subsea equipment.

According to Rockhopper’s report, Navitas’ target for FID remains mid-year 2025.

The announcement follows the updated NFB independent resource report conducted by Netherland Sewell & Associates (NSAI), released in March 2025, on behalf of Navitas.

The report reflects work carried out to mature the resource base and accelerates later phases of the development program in the build up to FID.

Overall resources at Sea Lion remain unchanged. As a result of the work carried out, a significant number of barrels have been moved from ‘Development On Hold’ to ‘Development Pending’ classification.

The new March 2025 NSAI report, which Rockhopper said it had not reviewed, categorizes the Sea Lion resources into the several developments, including Northern area with three phases, Central area with two phases.

Northern Area Phases 1 and 2 will be developed using a redeployed and upgraded FPSO that is expected to be secured upon FID.

Northern Area phase 3 and the Central Area Phases 1 and 2 will require a substantially larger replacement FPSO to be identified and secured, according to the report.

The Development on Hold category of 178 MMbbls 2C includes gross resources within Sea Lion and Isobel/Elaine, that could be developed under future phases but for which there is currently no published development plan.

According to the key information from the report, the 2C Contingent Resources (Development Pending) phased development concept for the Sea Lion field includes a total of 64 wells through phased development, with total barrels developed in all phases to be 730 mmbbls.

Phase 1 and Phase 2 togetther will have peak production rate 55,000 bbls/day, increasing up to 150,000 bbls/day once all phases have been developed, the report states.

As the project moves further along the path towards FID, Rockhopper intends to commission its own Independent Resource Evaluation which will be published later this year.

Rockhopper holds a 35% working interest in Sea Lion and associated NFB licenses and benefits from various loans from Navitas in relation to the development. Navitas is the operator and holds the remaining 65% working interest.