Shell Seeks Exit from al-Omar Oilfield, US Companies Show Interest

January 19, 2026

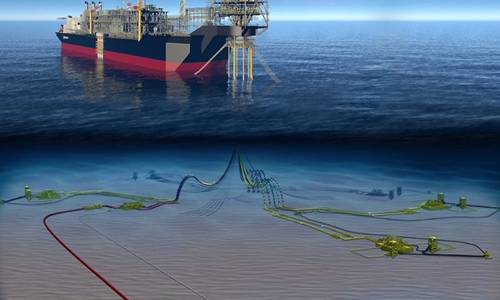

The head of the Syrian Petroleum Company, Youssef Qeblawi, said on Monday that oil major Shell had asked to withdraw from the al-Omar oilfield and transfer its share to Syria's state-owned operators but that U.S. companies were interested in the country's energy sector.

The al-Omar oilfield, Syria's largest, came under government control at the weekend after a lightning offensive against Kurdish forces who had held the site for nearly a decade and used it as a military base.

Qeblawi, speaking from al-Omar, said the field had operated as a joint venture between the Syrian Petroleum Company and Shell. The London-listed oil major had suspended all of its activities in Syria, including exploration and production activities, in December 2011 after the outbreak of Syria's war and European Union sanctions on Syria's oil sector.

Syria was still negotiating terms of a financial settlement with Shell so the field could be operated fully by state-owned Syrian companies "within a very short period", Qeblawi told reporters without specifying a timeline.

Shell did not respond immediately to a request for comment.

Qeblawi also said that ConocoPhillips would return to invest in Syrian gas fields.

The Syrian Petroleum Company signed a memorandum of understanding with ConocoPhillips in November to develop existing gas fields and begin exploration for new fields.

Other U.S. companies, including Chevron and HKN Energy, have also expressed interest, Qeblawi said.

A spokesperson for Chevron said the company "is constantly reviewing new opportunities to support our upstream business. Chevron does not comment on commercial matters.“ ConocoPhillips and HKN did not reply immediately to requests for comment.

Syrian President Ahmed al-Sharaa met Chevron representatives in Damascus last month.

Qeblawi said the field had once produced 50,000 barrels per day but that Kurdish forces operating it had used "primitive methods" that produced only 5,000 barrels per day. The field requires repairs and modernisation to be operable, he said without sharing details on cost estimates.

Qeblawi said that Chevron would be investing in offshore fields and Syria would soon be exporting both oil and gas. He said Syria's oilfields were achieving cumulative output of less than 100,000 barrels a day, down from 400,000 barrels before the start of the war in 2011.

While some fields in the northeastern-most province of Hasakah remained outside Syrian government control on Monday, Qeblawi said Syrian troops were working to secure control of all remaining sites.

"It's just a matter of time; everything will be ours - all fields without exception," he said.

(Reuters)