German Maritime Fleet: Resilient Strength in Turbulent Times

March 11, 2025

Germany’s maritime industry is proving resilient amid global economic uncertainty and shifting geopolitical priorities. At the annual conference of the German Shipowners' Association (VDR), statistics underscore the sector's role in securing trade, employment, and economic stability. Despite mounting challenges, German merchant shipping remains a powerhouse—supporting nearly half a million jobs and ensuring the steady flow of essential goods into and out of the country.

A Maritime Powerhouse

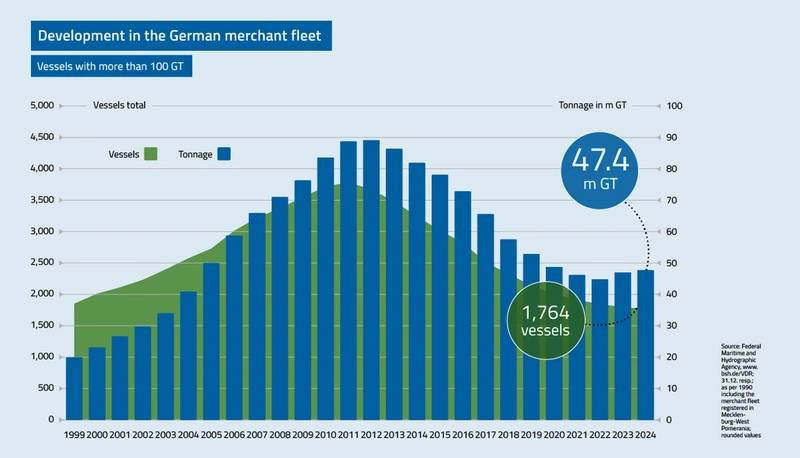

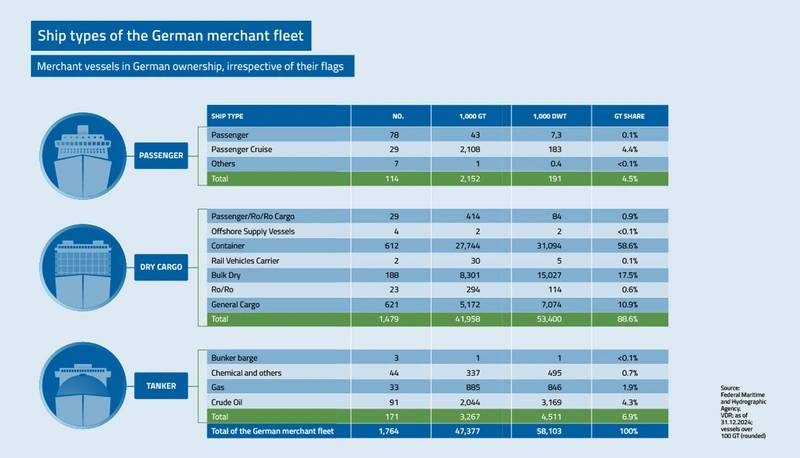

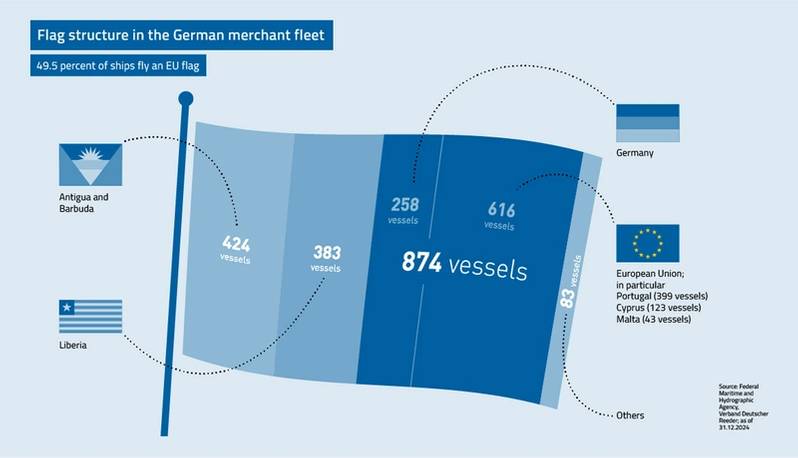

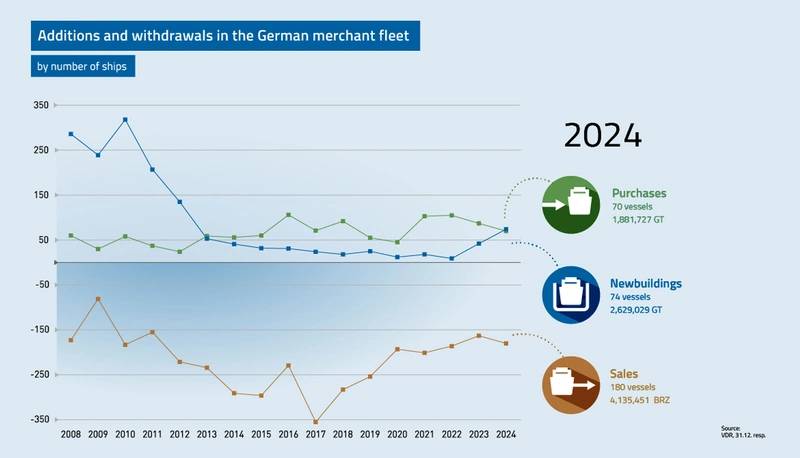

Germany boasts a fleet of 1,764 ships, ranking it seventh among global merchant shipping nations. With a gross tonnage of 47.4 million, the nation continues to be a key player in global trade. More than 60% of German imports and 62% of exports depend on maritime transport, highlighting the industry’s indispensable role in sustaining the country’s economic momentum.

“Without a strong and independent merchant fleet, there is neither economic stability nor national security—especially in times when geopolitical and trade policy risks are steadily increasing,” emphasized VDR President Gaby Bornheim.

Image courtesy VDR

Image courtesy VDR

Navigating Geopolitical Storms

As global trade routes face escalating risks—from tensions in the South China Sea and the Taiwan Strait to instability in the Black and Red Seas—Germany’s maritime industry finds itself on the frontline of geopolitical crises. Attacks on commercial vessels and potential disruptions to critical trade lanes pose significant threats to the flow of goods.

Meanwhile, protectionist policies, including the U.S. administration’s imposition of 25% tariffs on European goods and proposed fees on China-built ships entering American ports, add further uncertainty. These measures risk fragmenting global supply chains and driving up operational costs for German shipping companies. The prospect of reduced U.S. naval commitments only heightens the urgency for Germany to bolster its own maritime security and independence.

“As a leading export nation with scarce natural resources, we rely on secure and open trade and shipping routes. A consistent national maritime security strategy, enhanced naval presence, and closer cooperation between security authorities and the merchant fleet are essential,” said VDR CEO Martin Kröger. “Security comes at a cost—hesitation costs even more.”

Image courtesy VDR

Image courtesy VDR

A Competitive Edge, but it's Under Threat

While Germany remains a major maritime hub, international competition is intensifying. In container shipping, Germany (30.2 million GT) now ranks behind Switzerland (34.7 million GT) and China (31 million GT), demonstrating the shifting balance in global shipping dominance.

To maintain its competitive edge, the VDR is calling for targeted measures to support German shipping companies and the maritime sector. With 80% of German shipping firms classified as small or medium-sized enterprises (SMEs) operating fewer than ten ships, ensuring long-term viability is crucial.

“The international competition among merchant fleets and shipping hubs is intense and dynamic, with increasing pressure,” Kröger warned. “We must secure the competitiveness of our German merchant fleet in the long run and consistently support our maritime SMEs.”

Image courtesy VDR

Image courtesy VDR

A Surge in Maritime Careers

One bright spot in the industry is the renewed interest among young professionals. The number of new training contracts has risen by 14% in 2024, with 499 new trainees embarking on seafaring careers and 214 opting for shore-based roles. This uptick signals a growing recognition of the industry’s diverse opportunities and its role in the transition to greener shipping.

“Shipping needs visionary and motivated young professionals who not only want to actively shape the future of the industry but also take the decisive step toward a climate-neutral era with us,” said Bornheim. “It is incredibly encouraging to see more and more young talents recognizing the enormous opportunities in shipping and enthusiastically taking on this challenge.”

Image courtesy VDR

Image courtesy VDR

Red Tape Stunts Growth

Beyond geopolitical and economic hurdles, excessive bureaucracy within Europe is a growing concern for German shipping firms. Double reporting requirements and fragmented regional regulations, particularly in climate policy, create operational inefficiencies and put Germany at a competitive disadvantage.

“It is high time for Europe and Germany to abandon their dubious leadership in excessive bureaucracy and regional special regulations,” Kröger stated. “Streamlined processes and globally consistent climate protection requirements are essential to safeguard Germany’s economic strength at sea.”