US Offshore Wind Segment Showing No Signs of Slowing Down

Philip Lewis

June 1, 2022

The U.S. offshore wind segment shows no signs of slowing on its journey to deploy 30 gigawatts (GW) of offshore wind by 2030 and 110 GW by 2050. Based on current project activity we anticipate around 60 GW of offshore wind capacity to be installed by 2035.

By 2035, we will see offshore wind turbines operating in the Atlantic and the Pacific and probably the Gulf of Mexico. We will also see an emergence of commercial scale floating wind farms around the end of the decade. Floating wind farms bring a whole range of interesting technical challenges and opportunities for the supply chains that are currently not seen with the Atlantic bottom-fixed projects.

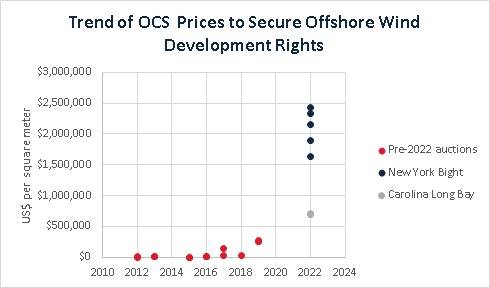

Among foundations for the positive outlook, two major Outer Continental Shelf (OCS) projects with around 940 megawatts (MW) of capacity have reached final investment decision (FID) and have commenced onshore construction, 11 OCS developments with a potential for more than 17 GW are undergoing federal permitting review and 17.5 GW of project capacity has secured offtake commitments from states. The Bureau of Ocean Energy Management (BOEM) has completed a successful Carolina Long Bay auction and has launched the leasing process for over 4.5 GW of floating wind capacity offshore California, while further auctions are planned for the South Atlantic, the Gulf of Mexico, the Central Atlantic, Oregon and the Gulf of Maine before the end of 2024. In addition, an unsolicited request has been submitted to develop a 2 GW floating wind farm in Washington State. Meanwhile, turbine component, foundation and cable factories and Jones Act wind farm vessels are being built in the U.S., and offshore wind port development is accelerating.

(Source: Intelatus Global Partners)

(Source: Intelatus Global Partners)

Intelatus Global Partners has just released the latest in its series of market reports identifying the opportunities and challenges associated with the U.S. offshore wind industry. Our forecast accounts for projects that will install close to 70 GW of capacity in this and the next decade. The forecast capacity will require capital expenditure amounting to $205 billion to bring onstream, a recurring annual operations and maintenance spend of $7 billion once delivered, and close to $31 billion of decommissioning expenditure at the end of commercial operations:

•Two offshore wind projects have passed the FID stage, have finalized major contract commitments and have commenced onshore construction.

•An FID is expected within the next 18 months for four OCS bottom-fixed project and two demonstration projects, one of which floating wind technology.

•16 projects are in the midterm planning stage where an FID is expected between 18 and 36 months.

•Seven projects are in the early planning stage where an FID is expected to be taken in 36-60 months.

•Another 13 areas will support close to 17 GW of future offshore wind projects and where an FID is expected after 60 months.

•There are a further 27 offshore areas at the planning stage in the Atlantic, Pacific and Gulf of Mexico that will support the longer-term U.S. ambition of deploying 110 GW of offshore wind by 2050.

Details of all U.S wind projects and developments are discussed in Intelatus Global Partners’ June U.S. Offshore Wind Report. Also in the project section of the report are details for over 60 projects in the planning stage, two projects in construction, and two wind farms currently in service. The report is accompanied by an online database. Information is current as of June 1.

For more information about Intelatus Global Partners' U.S. Offshore Wind Market Forecast, visit www.intelatus.com or contact Michael Kozlowski at +1 561-733-2477or Philip Lewis at +44 203-966-2492