Floating Wind and the Taming of Subsea Spaghetti

Wendy Laursen

October 31, 2024

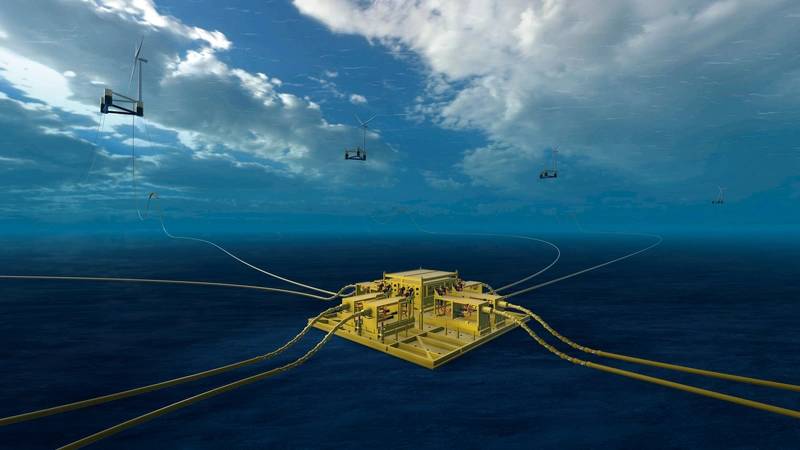

Preparing for industrialization, the floating offshore wind industry is tackling its unique mooring and cabling challenges.

The idea of keeping floating offshore wind platforms in place using dynamic positioning has been considered. The trouble is: it could take up to 80% of the electricity generated by the turbine to do it.

So, as Maersk Supply Service said a few years back: In a field of 100 turbines with 4-5 mooring lines each, there is going to be a lot of subsea “spaghetti.” It’s not a problem unique to the industry, but large floating wind farms will face the issue at a scale beyond that of fixed wind or O&G.

Ambroise Wattez, Director of Project Development at SBM Offshore, says a gigawatt floating wind farm would typically have 200 anchors and 200 kilometers of mooring lines. Basic principles and procedures have generally been adapted from O&G installations where there is a long track record of deploying mooring systems and hooking-up floating platforms with similar mooring characteristics, sizes and loadings.

Still, all the mooring components need to be transported, stored, marshalled and delivered to the site, and this can put local ports under strong pressure, he says.

For mooring and hook-up, most floating wind designs call for large AHTS of 200-300t bollard pull for towing and hook-up. For piling or anchor installation, offshore construction vessels with large crane capacity are typically suitable. “The availability of such assets is the primary concern. The Normand Installer, which combines these capabilities, is able to handle a floater mooring and hook-up scope, capitalizing on similarities with O&G deepwater installations, as demonstrated on the Provence Grand Large project.”

Mooring components need to be transported, stored, marshalled and delivered to the site, and this can put local ports under strong pressure.

Mooring components need to be transported, stored, marshalled and delivered to the site, and this can put local ports under strong pressure.

Ambroise Wattez, Director of Project Development at SBM Offshore

Source SBM Offshore

Wattez notes that some safety challenges differ from traditional O&G. “First, the small size of the platform not offering much protection to workers is leaning towards what is called ‘unmanned’ hook-up, where no personnel are transferred to the floating platform until it is fully moored. This comes with its own challenges in terms of design and operations. Second, the repetitive aspect of a wind farm installation, which can be equally an opportunity but also a challenge for the safety management requiring therefore strict and solid procedures.”

Added to mooring challenges is the need for the electrical cabling that takes the electricity to shore to be suitable for dynamic motion, as floating farms have half-suspended dynamic inter-array cables.

The dynamic cables in floating wind are usually fitted with bend stiffeners, buoyancy modules and tethers. “Combined with their relative smaller length, that makes the typical cable laying vessel not necessarily the best candidate for the job,” says Wattez. “Offshore construction vessels with vertical lay systems can be more efficient alternatives.” The Normand Installer is able to handle a floater mooring and hook-up scope, capitalizing on similarities with O&G deepwater installations.

The Normand Installer is able to handle a floater mooring and hook-up scope, capitalizing on similarities with O&G deepwater installations.

Source SBM Offshore

Aker Solutions has developed an alternative to the traditional daisy-chain arrangement for cabling multiple, typically five, floaters together. The daisy chain arrangement means that turbines further down the chain may require larger diameter cables, even up to a quarter of a meter in diameter, because they handle more power.

The company’s Subsea Collector provides an alternative solution that connects multiple wind turbines in a star configuration to floating wind’s first subsea power distribution system. Egil Birkemoe, Vice President, Electrical Transmission, at Aker Solutions, highlights how the star arrangement can be standardized, and as the cables can have a smaller diameter, motion issues associated with stiffness are reduced.

Egil Birkemoe, Vice President, Electrical Transmission, and Truls Normann, Senior Vice President - Power Distribution, of Aker Solutions with a 66kv subsea connector during testing.

Egil Birkemoe, Vice President, Electrical Transmission, and Truls Normann, Senior Vice President - Power Distribution, of Aker Solutions with a 66kv subsea connector during testing.

Source Aker Solutions

The system allows for more flexibility in farm architecture and construction, because each turbine is only connected to one cable, and the cables can be connected to a seabed substation before the floater is installed. The design also allows for reduced cable length per turbine and park, as well as less vessel time and installation costs. Initial findings support total cost savings on a 1GW floating wind farm of up to 10%.

The main component parts of the Subsea Collector comprise a 66kV wet mate connection system provided by Benestad and subsea switchgear with supervisory control and data acquisition by ABB.

Birkemoe says the technology is undergoing final certification before its first planned installation at the Marine Energy Test Centre (METCentre) 10 kilometers off the southwestern coast of Karmøy, Norway. Installation is planned to be carried out by Windstaller Alliance, an alliance between Aker Solutions, DeepOcean and Solstad Offshore.

The system itself was developed following the proven success of similar technologies in large installation projects, Aker Solutions’ experience in subsea power solutions for subsea gas compression and more recently for floating offshore wind like Equinor’s Hywind Tampen.

While having technology such as transformers subsea comes with cost considerations, he cites the O&G trend to have more infrastructure subsea including projects such as Åsgard and Jansz-lo.

In fixed offshore wind, the cost of cable supply and installation can account for 8-12% of overall CAPEX costs, and cable-related incidents account for around 80% of insurance claims. Without developments such as Subsea Collector, these numbers could be higher for floating wind.

Michael Bjerrum, CCO and Co-Founder of simulation, modelling and project management software company Shoreline Wind, says that planning for the interdependencies associated with the hook-up of floaters is a key consideration for project timelines. More broadly, there is a need for greater project optimization to help ensure that developers are bidding on projects responsibly. The small number of operating floating farms means they currently have limited data to draw from about both CAPEX and OPEX.

“This is where digital technology can play a role. For example, our simulation solutions help developers compare project layouts and optimize their transportation, installation and O&M strategies.” Shoreline Wind’s simulations can encompass different turbine and foundation technologies, long-term weather trends and the availability of ports and vessels.

Looking ahead, Bjerrum sees new technology developments will be needed to facilitate hook-up and also disconnection when turbines subsequently need to be towed to port for repairs. He also points to the importance of technology scale-up across the industry so that cost and efficiency gains can be made through industrialization. “The cost of fixed bottom offshore wind dropped about 70% over just nine years as a result of industrialization breakthroughs. Floating wind will need to go through that same sort of evolution.”

The cost of fixed bottom offshore wind dropped about 70% over just nine years as a result of industrialization breakthroughs. Floating wind will need to go through that same sort of evolution.

The cost of fixed bottom offshore wind dropped about 70% over just nine years as a result of industrialization breakthroughs. Floating wind will need to go through that same sort of evolution.

Michael Bjerrum, CCO and Co-Founder, Shoreline Wind

Source Shoreline Wind