Akrake Achieves First Oil at Sèmè Field as Parent Firm Reviews Options

February 19, 2026

Akrake Petroleum Benin, an indirect subsidiary of Rex International Holding, has achieved first oil from the AK-2H well at the Sèmè Field Block 1 offshore Benin, as drilling complications and cost overruns prompt a strategic and financial review.

Lime Petroleum, the parent company of Akrake Petroleum Benin, said the production from the AK-2H well is expected to begin within the next two weeks after the first oil was achieved earlier in February.

Earlier this month, Akrake completed drilling of the AK-2H horizontal production well at Sèmè Field Block 1, targeting the H6 reservoir in the Abeokuta Formation.

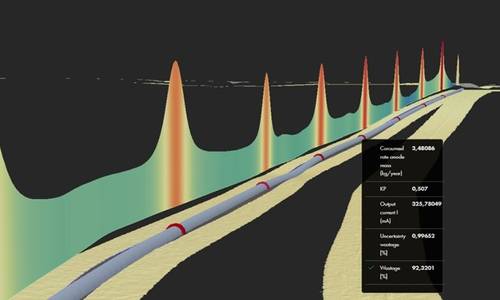

The well was drilled with a 1,405-metre horizontal section, including around 950 meters of oil-saturated sandstone. The reservoir section was completed with screens equipped with autonomous inflow control valves, and a downhole electrical submersible pump is being installed.

The well is intended to drain the western section of the field as part of the initial development phase, alongside the planned AK-1H horizontal well.

Despite reaching first oil, Lime Petroleum said drilling operations encountered significant technical complications, resulting in a material increase in drilling costs and a production delay of more than three months.

The company noted the overruns have had a material adverse effect on its financial position, adding that the board of directors and management are taking steps to safeguard creditor interests and maximize recoveries.

Lime Petroleum has engaged legal counsel to conduct a comprehensive strategic and financial review. The mandate includes evaluating alternatives to strengthen the company’s balance sheet and secure a sustainable capital structure.

Options under consideration include potential mergers or asset transactions, amendments to existing debt facilities and a broader financial restructuring. Lime Petroleum said it is in dialogue with creditors, suppliers and other stakeholders.

The company cautioned that there can be no assurance that the process will result in a transaction or outcome outside a formal restructuring proceeding, adding that in the absence of a timely recapitalization or restructuring solution, it may be unable to meet its financial obligations as they fall due.

The Sèmè Field is located in Block 1 offshore Benin. Akrake holds an approximately 76% working interest, while the government of Benin holds 15% and Octogone Trading holds 9%.