Argentina’s 30 MMtpa LNG Ambition by 2030 – Is It feasible?

by Melissa Lucio, Analyst, Latin America, Welligence Energy Analytics

August 15, 2025

The development Argentina’s vast Vaca Muerta share is transforming the nation into a rising energy exporter, with oil and pipeline gas already flowing abroad and an ambitious multi-phase ‘Argentina LNG’ initiative aiming to secure a permanent place in the global liquefied natural gas (LNG) market. While geological resources appear sufficient, the scale and pace of development, however, present challenges.

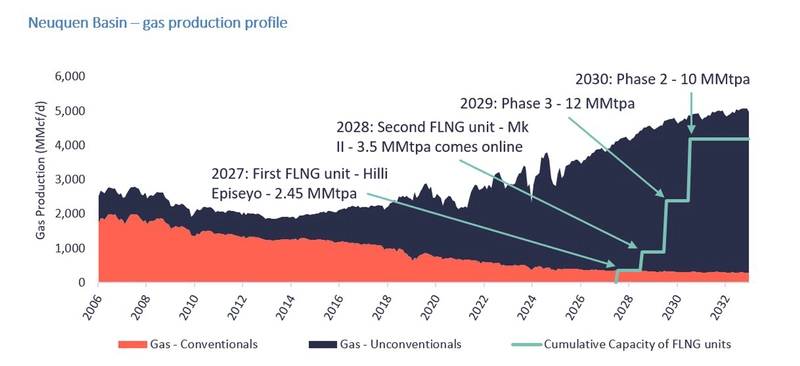

‘Argentina LNG’ is a large-scale LNG scheme designed to massively develop Vaca Muerta's resources to deliver energy to domestic and international market. It represents an ambitious collective of projects to be developed in following three phases:

Phase 1 (5.95 MMtpa): Southern Energy SA (SESA) – an incorporated JV comprising Pan American Energy, Pampa Energia, Harbour Energy, YPF, and Golar LNG – contracted Golar LNG to develop this phase through the Hilli Episeyo FLNG unit (2.45 MMtpa, to be redeployed from Cameroon) and the MK II (3.5 MMtpa, under conversion in China). Start-up of the first vessel is expected in 2027, followed by the second in 2028. A midstream player will construct a pipeline as part of the project.

The FLNG component of this first phase was admitted into the RIGI incentive program, which provides legal stability, the ability to repatriate profits, dividends, and capital, and shields the project from new national, provincial, or municipal taxes.

Phase 2 (10 MMtpa): In December 2024, YPF signed a Project Development Agreement (PDA) with Shell to develop this phase, which will involve the construction of two newbuilds of 5 MMtpa each. A new pipeline will also be required for this phase, which has a 2030 start-up target.

Phase 3 (12 MMtpa): In June 2025, YPF signed an agreement with Eni to develop this phase via two newbuilds of 6 MMtpa each. Start-up in 2029 is the target.

Nonetheless, YPF’s ongoing legal battle with Burford Capital over the Argentine government’s expropriation of the NOC in 2012 poses a risk. On 30 June, a New York court ordered the transfer of the 51% expropriated stake as a partial payment to Burford. On 15 July, Burford agreed to suspend the transfer until the final decision is reached on Argentina’s appeal in 2026. Until this is resolved, uncertainty will persist.

© Welligence Energy Analytics

© Welligence Energy Analytics

At full capacity, the project will require 4.2 Bcf/d of feedgas, essentially the country’s entire production today. While we have no doubts about the Vaca Muerta shale’s subsurface capacity to supply gas, we believe meeting the aggressive timelines to deliver LNG will be challenging.

LNG Marketing Continues

In January 2025, YPF signed an MoU for up to 10 MMtpa with India’s ONGC, Gas Authority of India Limited (GAIL), and ONGC Videsh. Due to the high volatility of Brazilian LNG demand, given the country’s seasonal hydropower output, Argentine LNG exports are expected through spot and short-term contracts. Meanwhile, Asian buyers continue evaluating additional LNG sources as they diversify away from the US and Qatar, while European buyers could benefit from their proximity to Argentina. Other potential offtakers are ADNOC, through its XRG subsidiary, and CNOOC, which holds a 25% stake in Pan American Energy.

While Argentina’s investment environment has improved, some LNG investors and buyers remain averse to long-term investments in Argentine LNG projects and contracts, particularly given the country’s short-lived Tango FLNG export experience during 2019-2020.

© sedsembak / Adobe StockThe FLNG Construction Challenge

© sedsembak / Adobe StockThe FLNG Construction Challenge

YPF plans to construct four newbuild FLNG units, with capacities of at least 5 MMtpa – the largest ever built. We believe delivering these vessels on time will be challenging.

- The world’s biggest FLNG units: The proposed capacities of the new vessels are a step change from the 3.6 MMtpa capacity of the world’s current largest operational FLNG unit, Shell’s Prelude FLNG project in Australia.

- Fighting for dock space: Securing shipyard capacity will be difficult, as the FLNG hulls will be newbuilds and must compete for dry dock slots with other facilities.

- New contractors needed: Shell and Eni have experience working with Samsung Heavy Industries (SHI), responsible for constructing the Prelude and Coral South FLNG vessels. Others, like Keppel in Singapore and CIMC Raffles in China, are specialists in FLNG conversions. Wison in China also has experience in the

FLNG market and has been contracted by Eni to build its second FLNG vessel for offshore Congo-Brazzaville.

Fierce global LNG supply competition

Between 2026 and 2030, the global LNG market will see an unprecedented wave of new liquefaction trains coming online, particularly in Qatar and the US Gulf Coast. Numerous pre-FID projects will compete with the Argentine projects. Moreover, the global pre-FID projects could pose a bigger challenge for Argentina LNG’s Phases 2 and 3, as most of the other pre-FID projects are in regions where some projects have already come online and their reliability has been proven, e.g., the US Gulf Coast.

Due to its smaller capacity and earlier start-up, the first phase of the Argentina project will have a better chance of competing in the LNG market.

About the Author: Melissa Lucio is a Latin America Analyst at Welligence Energy Analytics, based in Houston. She covers upstream activity in Argentina, the Falkland Islands, and Uruguay. She holds a Bachelor’s in Economics from Stanford University. Prior to joining Welligence, she worked in LNG research, focused on North American markets.

About the Author: Melissa Lucio is a Latin America Analyst at Welligence Energy Analytics, based in Houston. She covers upstream activity in Argentina, the Falkland Islands, and Uruguay. She holds a Bachelor’s in Economics from Stanford University. Prior to joining Welligence, she worked in LNG research, focused on North American markets.