Brent Oil Prices Hover While Facing Geopolitical Tensions, WTI Weakens Further

August 13, 2025

Brent oil futures are hovering around $66–67 per barrel with mixed geopolitical signals, while West Texas Intermediate (WTI) has weakened relatively more.

The US-China tariff truce extension by 90 days reduced bearish sentiment, while the uncertainty of US-Russia peace talks continues to add a bullish risk premium given Russian oil buyers could face more economic pressure. Significant diplomatic collaboration is emerging among Brazil, Russia, India, China and South Africa (BRICS), given the unexpected flow of Russian crude and/or products.

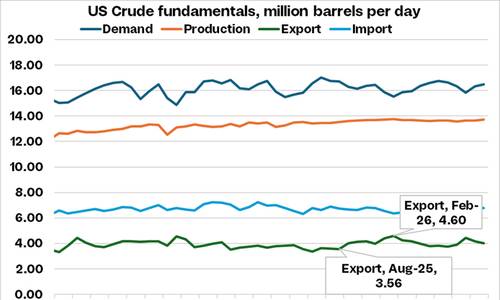

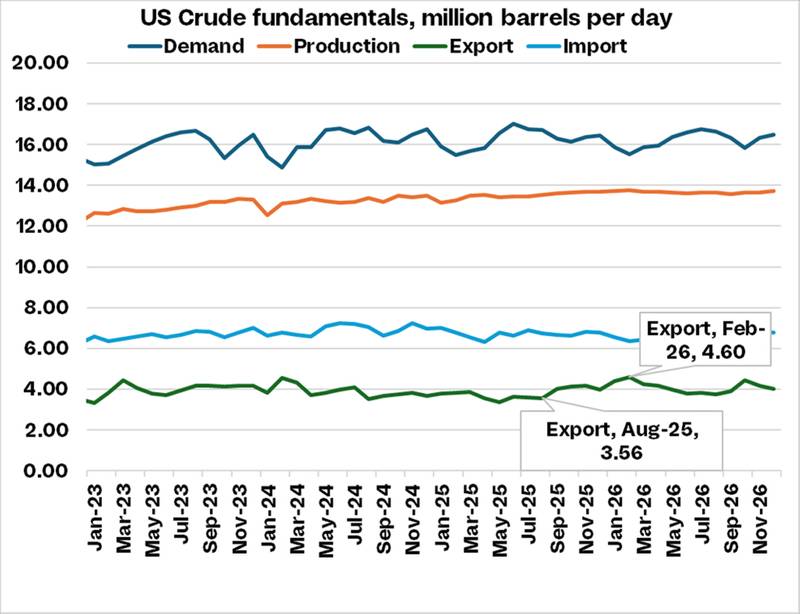

While the Brent market is waiting for direction, the WTI market is moving differently as US oil fundamentals evolve post-summer. Rystad Energy projects that by Feb. 2026, the crude exports, primarily light sweet, need to touch near 4.6 million barrels per day (mbd) from current 3.6 mbd otherwise WTI will weaken further for storage or production cuts.

The weakening of WTI and the stronger need for heavier and medium sour barrels for US refining is going to keep discounts of Canadian barrels (WCS) to WTI in check near $12-13/bbl. As the Trump administration pushes to sell more WTI barrels to Europe and Asia, they will be challenged on three counts:

- Competition in Asia as OPEC+ plans to bring more barrels to market while China is not growing as strongly as expected and refinery maintenance is ahead in Q4

- Competition in Europe as the Middle East and Asia refiners push refined product exports

- The light sweet quality of WTI barrels is what the rest of refining does not want relative to hunger for medium sour barrels. There is a greater divergence emerging in WTI discount to Brent prices ahead than what the future curve is suggesting around $3.5-3.6/bbl.

The deeper answers for weakened WTI are evident in the following key data points on US oil fundamentals:

Post August peak demand, September is projected to register a 0.5 million barrels per day (mbd) lower overall demand in the US. The bulk of this demand drop is going to be in gasoline and jet fuel demand and the trend will continue towards year-end. The distillate fuel demand may provide some offset with seasonal increases towards year-end. Overall, the demand for crude by refineries is projected to decline from peak August to October by 0.9 mbd with some recovery towards year-end. This signals pressure will build on WTI barrels to clear exports or get stored.

Overall, the growth in light sweet production is estimated to be around 400,000 bpd year-on-year with heavier and medium quality declining by 100,000 bpd capping the net growth to near 300,000 bpd. This would mean a second year of growth, lower than 500,000 bpd. This muted production outlook is likely to provide some floor in WTI weakening.

US commercial crude inventories have been running below seasonal minimums since late June, currently 5.7 million barrels under the seasonal low. The shortfall has been driven by strong summer refining demand, but with runs set to slow after the peak season, the deficit is likely to narrow, easing some of the immediate stock tightness. The WTI curve shows decent backwardation in the prompt three months in the range of $ 0.70 to 0.30 /bbl. This indicates that there is a higher need for WTI barrels to arbitrage for exports vs. storage. The funding for any strategic petroleum reserve (SPR) build-up was reduced drastically in the latest One Big Beautiful Bill Act (OBBBA) and it is unlikely that any plans to store WTI light sweet exist. The inventories for lighter molecules and natural gasoline liquids (NGLs) are at an all-time high indicating overall too much lightening of the US feedstock system.

Globally

The supply side in Canada is about to shift. Oil sands maintenance scheduled for September–October will temporarily cut heavy sour output by 100,000-200,000 bpd. The total outages during the period are expected to reach over 600,000 bpd. Larger or extended outages from Suncor, CNRL, Imperial, or Syncrude would reduce heavy sour supply and support WCS pricing. Overall, the flow of barrels from South American countries is also on downward trajectory.

The pull for WTI barrels by rest of the world’s refineries is also challenged. OPEC+ barrels are competing for Asia market demand. Competition between Middle Eastern and Russian barrels is strong, as China is not running refineries hard. China building its stocks is likely to keep Brent prices sliding towards the low $60s. The question is how long. The European refining system faces the challenge of inflow of refined products from the Middle East and Asia and thus provides a back pressure to aggressive buying of WTI by EU buyers. US trade deals pushing higher sales of WTI barrels is a clear acknowledgement that pull is not strong. Since early 2024, US exports have been sliding from a total of 4.6 mbd to now near 3.6 mbd, indicating the weakness in the pull.

Thus, with lower projections of supply from northern and southern borders it is likely to support imports from the Middle East to cover the quality shortage for refineries. Any incremental WTI barrels must clear to exports. The WTI-Brent discount differential is likely to touch near $4.0+/ bbl vs. $3.6/bbl projected in the futures curve by Q1 2026. How Ukraine-Russia crisis resolves, and Russia flows change could bring some unexpected surprises. It is very unlikely that Russian barrels will flow back to Europe and US will not let European crude shorts slip back into hands of Russia.